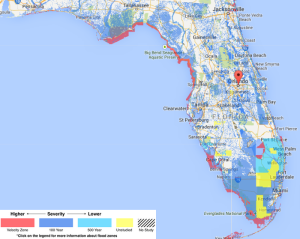

The MoversAtlas team has been hard at work over the past few months and we are now excited to announce that the move map now has a flood zone map for the state of Florida! The new flood zone feature can be turned on by going to the MoveMap page and then clicking on the Heat Maps section on the left hand side and then turning on the flood zones radio button. Once you have the flood zones turned on you will see an overlay of four different shades of color appear on the map, red being the highest risk and light blue being the lowest risk and then yellow indicating unstudied areas.

The biggest deal with flood zones(besides the possibility of your house being filled with water) are that they are typically reported back to insurance companies and even if it’s not in a high hazard zone the rates can still be much higher than other areas. The flood zones on the MoveMap are geographic areas that FEMA has defined the different level of flood risks.

If you have been in the state of Florida for a while you are probably familiar with the many marshes, wetlands, everglades and other low areas that are wet just about year around. With that said you should remember that the entire state is right at sea level and to a point there are reasons why that some flood zones are important but some do not necessarily need to be worried about.

Flood zones or hazard areas are identified as a Special Flood Hazard Area (SFHA). In essence the SFHA are defined as the area that will be inundated by the flood event having a 1-percent chance of being equaled or exceeded in any given year. The 1-percent annual chance flood is also known as the “100-year” flood, subsequently the .2 percent is known as the “500-year” flood.

The SFHAs are labeled Zone A, Zone AO, Zone AH, Zones A1-A30, Zone AE, Zone A99, Zone AR, Zone AR/AE, Zone AR/AO, Zone AR/A1-A30, Zone AR/A, Zone V, Zone VE, and Zones V1-V30. Moderate flood hazard areas are labeled Zone B and X (shaded) and low are Zones C and X (unshaded) along with Zone D which are undetermined risk areas but still could flood or have higher insurance premiums.

The highest flood zone area is known as a “V-Zone” which is typically first row beach front, this is obvious due to the high winds, possible waves and low areas.

“A” zones are the next most volatile which are subject to rising waters or near lakes and rivers. These areas are also known as high risk and require flood zone insurance coverage. Each letter and numbering distinguish different requirements for building construction and your surroundings.

We hope this information will give you better knowledge of the flood risk of your home, neighborhood, and its surrounding areas. We encourage you to use the new flood zone feature when searching for a new home in Florida so you can have an idea of the risks and potentially higher insurance premiums before you buy your new house! Also, make sure to check out all the other great information and tools on MoversAtlas.com to help make your home search easier!