So you are looking to invest in a piece of rental property and the thought of that supplemental income sounds like it could really help out. You buy a house, rent it out and someone else pays your mortgage and make a little extra. Then after 15 or 20 years you have a paid for rental property that your renters paid off for you over the years. The house has appreciated nicely so now your investment is worth 20-30% more then what you originally paid! That’s what most people think of when they consider buying a rental property, however, it is not always that simple. Here are three things you should consider when looking to invest in a rental property:

or 20 years you have a paid for rental property that your renters paid off for you over the years. The house has appreciated nicely so now your investment is worth 20-30% more then what you originally paid! That’s what most people think of when they consider buying a rental property, however, it is not always that simple. Here are three things you should consider when looking to invest in a rental property:

1. Location – This must be considered as you are deciding the caliber of houses and tenants you are considering to rent to. Keep in mind anyone can be late or delinquent on rent but it will be important not to purchase a highly expensive home in a very middle class neighborhood, nine times out of ten you won’t be able to get the amount of rent you are looking for to cover the expenses. Also consider how far is it from your residence? If you are planning on managing the property yourself it may not be the best idea to be the landlord if you live in another city state because if you can’t drive by on any given afternoon you to check up on everything or get there quickly to fix minor problems you are going to have to pay someone to do these things which could eat away at your profits.

2. Investment potential – Of course you want to charge as much money as you can for rent each month to to cover the mortgage and make a decent profit. This equation seems easy enough but you need to investigate on a few things before you go off buying something cheap and trying to rent it for a ton of money. Is there any rental history? What are the properties expenses for insurance and taxes? What are the home’s previous values? Has anything major been replaced or repaired? Is there an HOA? If so what are the HOA fees and how involved do they get in the yard upkeep and house conditions? These questions will help you get a better idea of what you are in for and if there will be enough money at the end of the month to make it worth your while.

3. Upkeep – Okay you understand that if you buy a house with an old roof you will have to replace it at some point but what if you look at it a little deeper. Try to consider the ongoing maintenance the property will need. Think about how the landscaping is set up, are there hundreds of feet of fancy shrubs, landscape lighting, gardens? Is there a pool? All of these things cost money on an ongoing basis to keep functioning properly and looking nice. And these expenses aren’t just limited to the exterior of the house, the inside of the house is a whole other story. Wood floors can be damaged easily, walls can be scuffed up, carpets can get stained. Of course you have deposits that will cover some of these things but have to be prepared for the extra work and the headaches these issues cause.

4. Unexpected expenses – Lastly, it is extremely important that you factor in the costs of unexpected expenses. You never know when the A/C will break or when a pipe will burst and when something like this does happen it can be very expensive. Many people just hope for the best and pray nothing like this will happen to their rental property but this is a poor strategy. You need to plan ahead and make sure you have money budgeted and stored away for any unexpected expenses. This means planning a little more carefully and maybe taking a little bit of the rent you collect each month and putting it into and emergency fund. Also, you can reduce the risk of something like this happening by doing routine maintenance on all important and expensive items. Doing this may cost a little money upfront but could end up saving you in the long run.

These are just a few things to keep in mind when considering making an investment in a rental property. However, don’t let these things scare you away from buying a rental property because real estate is one of the greatest investments you can make but you just need to do it wisely. Hopefully, you can take this information we provided you and use it to better prepare yourself for a successful rental investment.

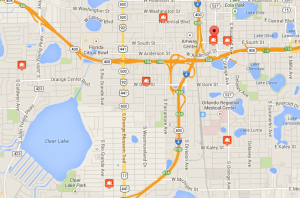

If you are looking to by property in Florida make sure to take a look at the MoveMap on www.MoversAtlas.com to get detailed information on the neighborhoods, communities, and cities you are looking to buy real estate in!